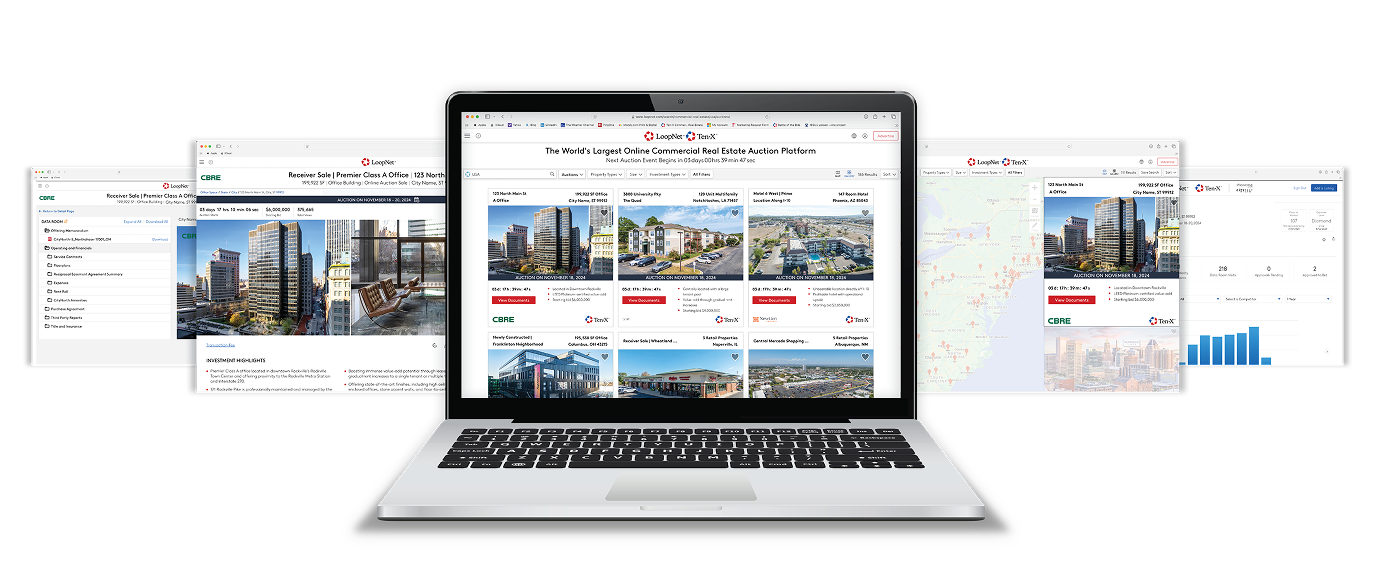

TEN-X AUCTIONS NOW ON LOOPNET

Ten-X auctions are now on LoopNet, the world's largest commercial real estate marketplace. We're simplifying the way investors underwrite, bid, and buy.

LOOPNET AND TEN-X TO POWER ONLINE CRE TRANSACTIONS

Ten-X is the #1 transaction technology powering commercial real estate sales online. We've united with LoopNet to deliver the most expansive pool of buyers and real-time asset intelligence powered by CoStar data. Together, we make transactions twice as fast and twice as certain for brokers, owners, and investors.

SPEED

Our condensed process accelerates the sales transaction to under 100 days, getting our clients from list to close faster.

97 Days

Avg List to Close

•••

REACH

We market your listing to the largest qualified global buyer pool, using comprehensive multi-channel marketing to help put your property in front of the perfect buyer.

13 Million

Unique Monthly Visitors

•••

CERTAINTY

We implement upfront bidder qualification and due diligence, reducing the risk of fallouts and retrades so you can close with confidence.

95%

Close Rate

•••

INVESTORS OF ALL SIZES SEARCH LOOPNET AUCTIONS EVERY MONTH

HELPING BROKERS, OWNERS, AND INVESTORS TRANSACT CRE FASTER

Our customized marketing solutions use best-in-class technology to put your listing in the best position to find your perfect tenant or buyer.

CRE AUCTION NEWS, INSIGHTS, EDUCATION AND STORIES

Stay up to date on the commercial real estate landscape with engaging content from our experts. Explore CRE insights, educational articles, recent success stories, and more.

KNOWLEDGE CENTER

Auction eXperts | James Nelson - Principal & Head of Tri-State Investment Sales, Avison Young

Contracts & Closing Guide

Auction Success Stories

Building the Deals: Barrington One